In the next 18 months, the U.S. will see more solar installations than ever before. The federal investment tax credit (ITC) is a 30 percent tax credit for residential, commercial and utility scale systems. Tax credits work by reducing dollar-by-dollar the taxes that would be paid by the owner to the federal government. Please note that it is imperative that solar customers contact their accountant to ensure full utilization of the ITC before choosing solar.

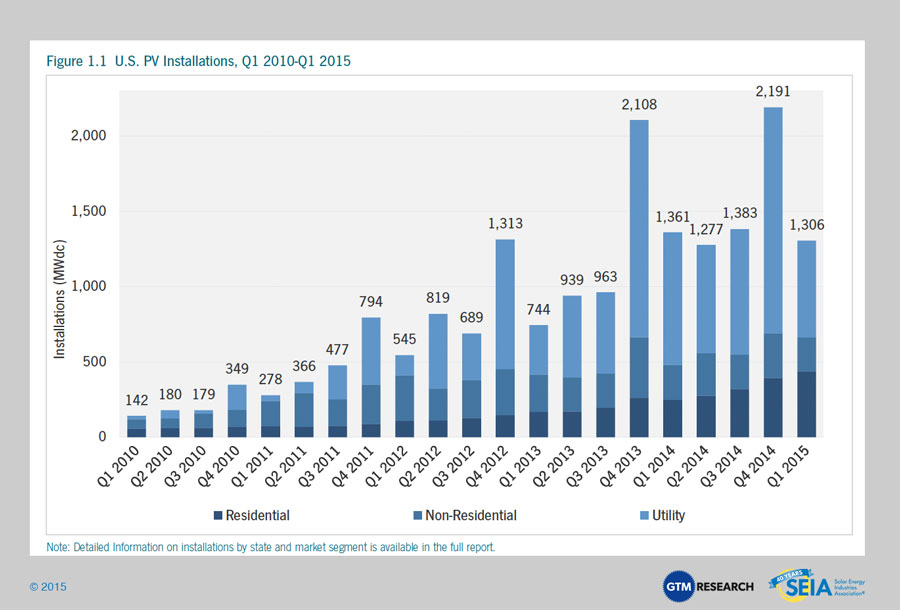

Since its implementation in 2006, the ITC has fueled a dramatic increase in solar installation and solar jobs all around the country. However, the ITC will only be in effect until December of 2016, and time is running short. Solar customers and installers know this and are installing solar in greater numbers than ever before. According to the Solar Energy Industry Association (SEIA), the first quarter of 2015, 51% of all new energy generating capacity in the U.S. came from solar PV, more than any other kind of energy including natural gas.

What this means for the individual solar owner, is that throughout 2015 and especially in 2016, the demand for solar installations will climb ever higher. It is estimated that the huge numbers of solar installations in 2015 will increase by 150% in 2016. Now is the time to book your solar installation, before the construction crunch.